Frederik van der Schoot, Oaklins Netherlands

Frederik van der Schoot is a Partner at Oaklins, Netherlands. Frederik and the Oaklins Netherlands Team completed over 60 deals on the Ansarada Platform in 18 months.

Frederik van der Schoot is a Partner at Oaklins, Netherlands. Frederik and the Oaklins Netherlands Team completed over 60 deals on the Ansarada Platform in 18 months.

After a flat few years, better times are expected for the Kiwi transaction market in 2026.

Despite the uncertain interest rate outlook, property investors are bullish about this stalwart asset class.

As an Analyst or Associate who’s juggling multiple deals, working long hours and buried in spreadsheets, choosing the right Virtual Data Room (VDR) isn’t a nice-to-have; it’s essential.

From 1 January 2026, Australian dealmakers face mandatory merger notification – meaning even straightforward acquisitions must clear ACCC approval within 30 days, with complex deals facing up to 90 days of rigorous review. Early preparation and strategic timing have never been more critical.

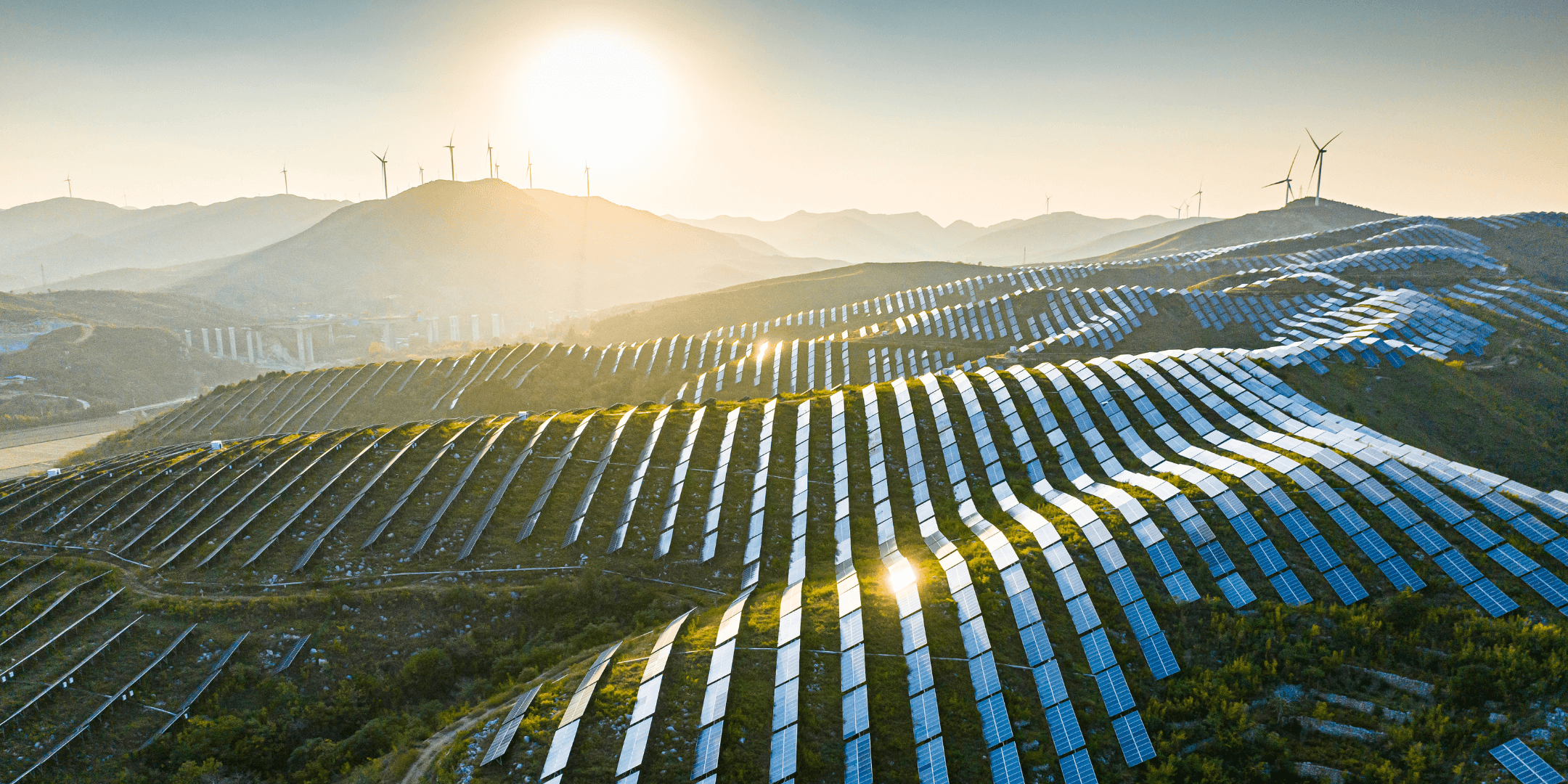

With abundant natural resources, New Zealand as a market is known for its energy transactions and energy plays have dominated deal flow throughout 2025, with eight major rumoured or announced deals totalling $1.0 billion, according to Mergermarket’s data.

Australia’s ongoing construction and infrastructure boom has seen overseas investor interest in essential building product suppliers.

Combined new entity a new force in the nation’s telecommunications market.

While it remains an emerging market, Africa’s up-and-coming generations will help support economic growth across the continent, according to Stokoe.

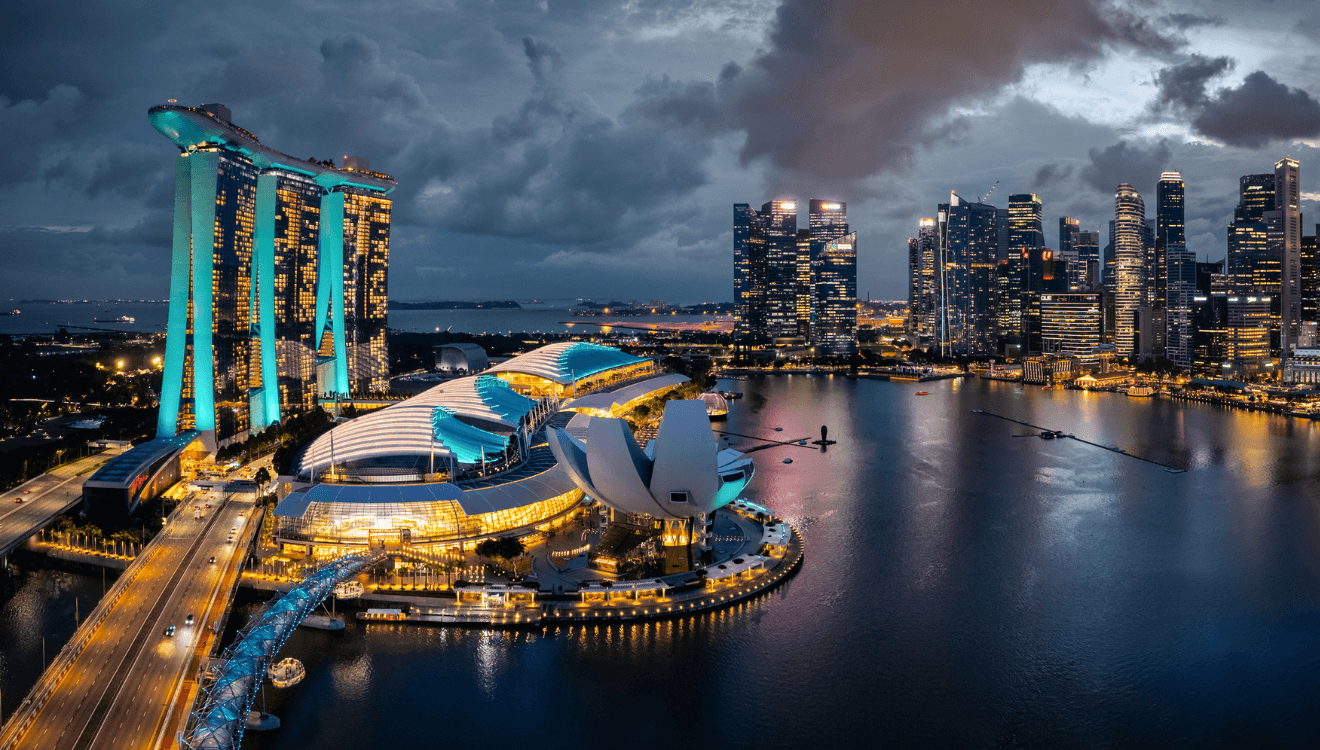

Off the back of a sluggish 2024, the Lion City has experienced a wave of mergers and acquisitions through 2025, with tech deals dominating deal flow.

Markets have been transfixed by energy market combinations, as the global transition to renewable market assets gathers pace.

From fintech unicorns to banking giants: Why $270bn+ in financial services deals signals the sector's biggest transformation yet.

Finland, Iceland, and other European countries show a clear competitive edge in digitalization, AI, medical equipment, biogenetics, and public efficiency improvement projects. In the second half of 2024, 4 in 10 deals involved a foreign deal partner.

Andrija and Adam explore Central and Eastern Europe M&A and private equity in 2025.

Peter McCrystal, former partner and director at PwC, and now a consultant, has enjoyed a career spanning several decades in due diligence. He has been at the forefront of transformative deals in the region, significantly shaping South Africa’s corporate landscape.